The

most commonly used forex trading strategy is breakout trading. A large number

of traders use this method as their entry mechanism. With proper money

management and risk control breakout trading can be profitable.

What

is a breakout?

A breakout is a movement/Break of price from a major

level. The level can be a major support or resistance (line or zone) or a trend

line etc.

How to identify a Breakout?

- Breakout can be a reversal or continuation of trend:

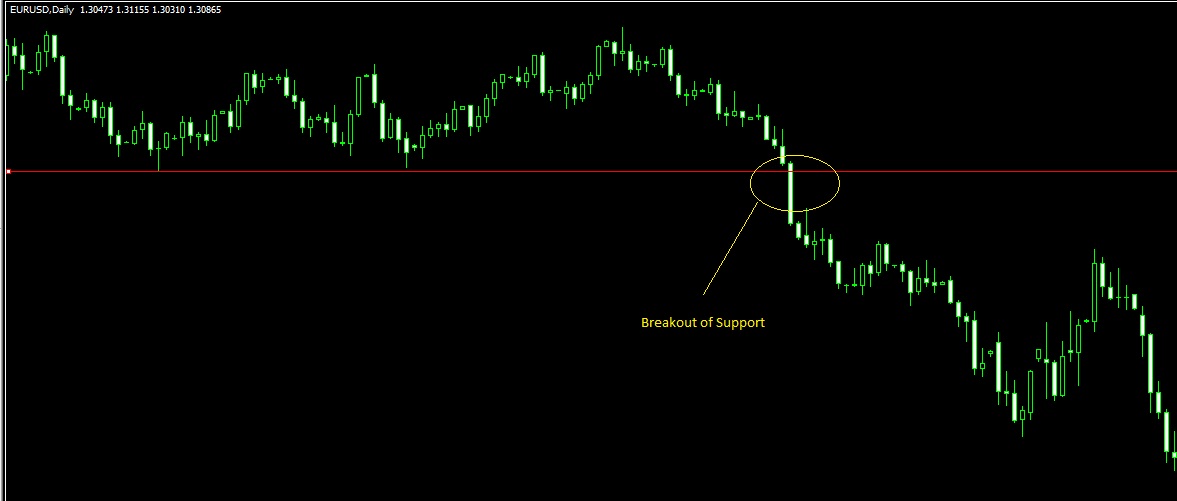

We

can see a breakout from a major support line which usually indicates a reversal

of the current trend. But in some cases if the current trend is really strong,

the breakout will be in the direction of the trend.

|

| Breakout from Range |

See the above chart. Price has been ranging from January 2012 till may 2012. On May 2012 the support line was penetrated and the candle closed below support level. This is called breakout ( see the yellow encircled portion).

After the Breakout price direction changes and down trend establishes. See the increase in volume during the breakout. this act as a confirmation of Breakout.

After the Breakout price direction changes and down trend establishes. See the increase in volume during the breakout. this act as a confirmation of Breakout.

|

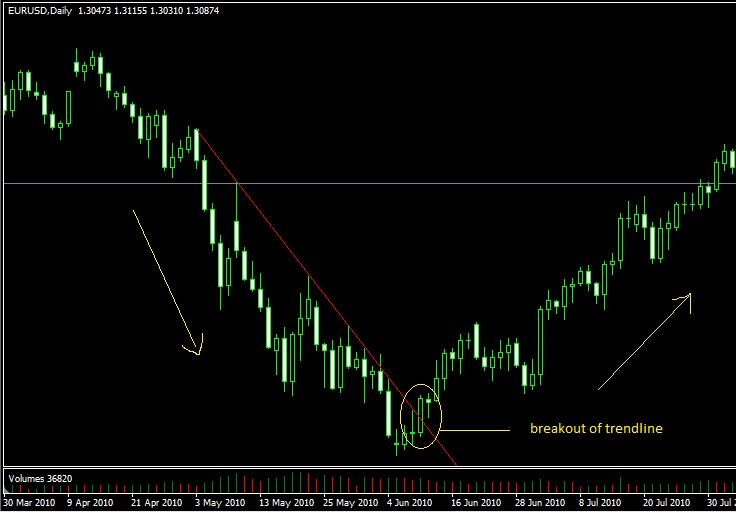

| Breakout @ Trend line |

The above chart shows the break out of trend line ( indicated by red line). See the change in direction of trend after the breakout.

- Candlestick patterns at Breakout: If the price breaks out of the major level with a candlestick pattern like engulfing bar,pin bar/hammer etc, chances are more that the breakout is a real one and you will be able to profit more pips.

Confirmation:

The

most important part of breakout trading is getting confirmation.

Need?

If

you are one of those traders who jump in to a trade as soon as the price breaks

S/R line or trend line, beware there is a 50% chance that you are in a wrong

trade. Fake breakouts are even more common than actual breakouts.

So

try to get in to a trade only after getting a confirmation, when you see a

breakout.

How

can you confirm?

Charles

.D.Kirpatrck in his book on Technical analysis explains several ways of

confirming a breakout. Some of them are

- Close of the candle.

Yes

you will have to wait till the candle closes to confirm the breakout. If the

breakout is upward make sure the candle closes above the breakout level and

vice verse. (This will actually save you from a lot of wrong trades. So please

be patient)

- Percentage filter:

If

the breakout candle is really big and the candle will close only after a long

time, chances are there that you will miss most of the journey of price. In

such a case check how much the price has penetrated to the breakout level. If

the % of penetration is more you can enter the trade even before the candle

closes. (Remember still there are chances for fake breakout.)

- Volume:

Another

major point of confirmation. If you see a very high increase in volume at the

time of breakout, chances that the breakout being real is more.If the price is making a new high or low, but volume is going in the opposite direction and then breakout happens and there is a sudden increase in volume, this is a highly reliable confirmation of breakout.

How

to exit from a breakout trade?

So

you have entered in to a breakout trade. Next question will be when to exit.

- One common method used to calculate possible price movement is measure the previous price activity. If before breaking out price was ranging, then measure the pips the price ranged. We can place the same amount of pips as the target of our trade.

- Another method is to go for a 1:1 risk reward ratio. So the target will be exact number of pips you are risking while placing the stop loss.

- In case of a wrong trade. try to get out of the trade as soon as you realise you made a wrong entry.

Importance of placing stop loss:

Another major point to be considered while trading breakout is placing stop loss. According to my personal observation stop loss is a must for every breakout trade. Placing a stop loss will save you from a large number of fake breakouts and there by save your hard earned money.

Examples:

Another major point to be considered while trading breakout is placing stop loss. According to my personal observation stop loss is a must for every breakout trade. Placing a stop loss will save you from a large number of fake breakouts and there by save your hard earned money.

Examples:

Some more examples of Breakout:

|

| Breakout @ support line |

The above chart shows breakout from a support line

|

| Real Breakout |

|

| False Breakout |

See the two charts above. The chart on the left side shows you a real breakout and on the right side shows you a fake breakout.On the right chart, the price has actually crossed the trend line ( indicated by red line), but price continued to go up. If you have entered in a short trade hoping that it is a breakout, within short period your stop loss would have been hit.

So while taking a breakout trade give extreme care, wait for confirmation and always use a stop loss.

No comments:

Post a Comment